Are Real Estate Taxes the Same as Property Taxes?

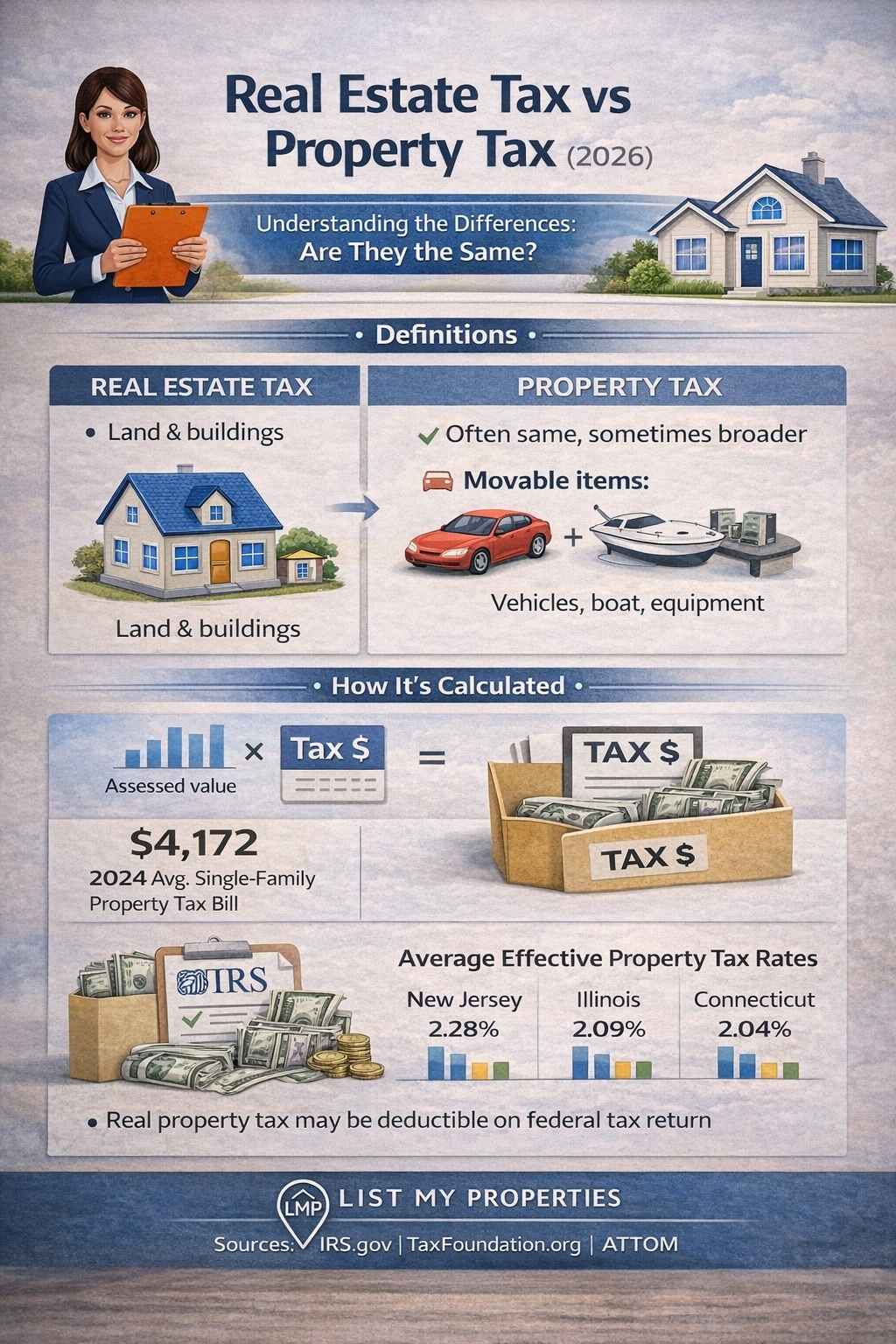

Many homeowners ask: are real estate taxes the same as property taxes? The short answer is: often yes in everyday language, but not always in legal or tax terms. In many U.S. counties, “real estate tax” and “property tax” are used interchangeably to describe the annual tax on real property (land + permanently attached structures). But in other contexts, “property tax” can be broader and include personal property tax on movable assets like vehicles, boats, or business equipment—depending on the city and state.

This guide is worth reading because it clarifies what each tax label typically means, how local governments calculate the tax rate using assessed value, what shows up on mortgage escrow and Form 1098, what is deductible on a federal tax return, and where confusion happens (mobile homes, school levies, “real property taxes” wording, and personal property).

Table of Contents

AI Overview (Google AI Overviews / Zero-Click Summary)

Are real estate taxes the same as property taxes? Usually, real estate tax refers to the recurring local tax on real property (land and buildings). The term property tax is sometimes used the same way, but it can also include personal property tax on movable items (cars, boats, RVs, business equipment), depending on state law. On mortgages, lenders often collect “property taxes” through escrow, which usually means the real estate tax bill. For deductions, the IRS allows itemizers to deduct certain state and local real property taxes that are based on property value and levied for general public welfare.

Featured-snippet style answer

Real estate taxes are usually the annual local tax charged on real property (land and a home). Property taxes often mean the same thing, but in some states “property tax” can also include personal property tax on movable assets, so the terms are not always identical.

Table: Quick comparison (real estate tax vs property tax vs personal property tax)

| Term used | What it usually means | What it’s based on | Who sets it | Where it’s paid |

|---|---|---|---|---|

| Real estate tax | Annual tax on real property (land + building) | Assessed value × tax rate | Local governments | County/municipality tax bills |

| Property tax | Often the same as real estate tax, but can be broader | Varies by jurisdiction | State and local | Local tax authority |

| Personal property tax | Tax on movable items (vehicles, boats, business equipment) | Value of asset (varies) | State/local | Local tax authority |

Are real estate taxes the same as property taxes?

In many U.S. communities, are property taxes the same as real estate taxes? In day-to-day conversation, yes—people often call the annual property tax bill on a home “real estate tax” or “property tax” with no difference. That’s because the most common property tax people pay is the real estate tax on a home and land.

However, the terms are not always identical. Some jurisdictions use “property tax” as an umbrella phrase that can include other taxes differ categories—especially personal property tax. This is why readers also ask are real estate taxes the same thing as property taxes or are real estate taxes the same as property—the wording changes, but the confusion is the same: the label depends on local law and billing language.

What is “real property” and why it matters

Real property includes land and improvements permanently attached to it—such as a house, garage, or other structures. In most counties, the annual real estate tax is an ad valorem tax (value-based) charged on the assessed value of real property. That assessed value is not always the same as market value, but it is tied to valuation (finance) methods set by the tax assessor.

This definition matters because many local bills and mortgage statements say “property taxes,” but what they really mean is the real property taxes assessed on the home. In other words, for many homeowners, “property tax” is shorthand for “real estate tax”—even though property as a general term can include more than land and buildings.

What is “personal property” and when it changes the answer

Personal property refers to items that are movable, such as a vehicle, boat, recreational vehicle, or certain business equipment and furniture. In some states or counties, these items may face a personal property tax—which is why people ask: are personal property taxes the same as real estate taxes and are real estate taxes the same as personal property taxes.

In strict terms, they are different types of tax: real estate tax applies to real property, while personal property tax applies to movable assets rather than real property. This is also why “property tax” can be confusing: it might mean only the home bill in one place, but it might include both categories in another place.

Mission Beach Vacation Rentals: Your Ultimate Guide to San Diego’s Coastal Getaway

Real estate tax vs property tax: what’s the difference in practice?

When a homeowner asks is there a difference between real estate taxes and property taxes, the practical answer depends on how the local property tax system is set up. In many counties, the annual bill is explicitly called “real estate tax” or “real property tax,” and it funds services like schools, police, fire, and infrastructure.

Where “property tax” becomes broader is when the jurisdiction also taxes personal property. Then the phrase “property tax” could refer to more than one bill—one for the home and another for personal or business assets. That’s why the safest approach is to check the bill’s wording, what it applies to (land/buildings vs movable items), and the statute or assessor’s category.

How property tax is calculated (assessed value, tax rate, effective tax rate)

Most real estate tax bills follow a core formula: assessed value × tax rate = annual tax. The tax assessment process sets the value, and the local tax rate funds public services. Property values rising often increases tax bills even if the rate stays the same.

A useful comparison tool is the effective tax rate, which reflects taxes paid as a percentage of home value. For 2025, Tax Foundation’s state-by-state data shows states like New Jersey at the top for effective property tax rates, with Illinois and Connecticut also high.

Latest data (2025–2026): average property tax bills and where taxes are highest

To add current context that many competitor posts skip:

ATTOM’s nationwide analysis reported the average single-family home property tax bill reached $4,172 in 2024, up 2.7% year over year.

Tax Foundation’s 2025 dataset ranks effective property tax rates by state and county (helpful for “what state has the highest real estate tax?” questions).

Mini table: “Highest property tax” reference (2025 effective rate ranking)

| Data source (2025) | What it shows | Why it helps |

|---|---|---|

| Tax Foundation – property taxes by state/county | Effective property tax rates; highest states listed | Answers “highest real estate tax” with credible data |

| ATTOM – 2024 property tax analysis | Average tax bills and regional differences | Adds real-world bill size and trend context |

Are real estate taxes paid the same as property taxes?

People also ask: are real estate taxes paid the same as property taxes? If the community uses the terms interchangeably for the home bill, payment works the same: the homeowner pays the county/municipality directly or through escrow.

But if “property tax” includes both real property and personal property, payment might happen through separate bills, different schedules, and different agencies. So the payment method is not defined by the label alone—it’s defined by the type of property and local rules.

Are mortgage real estate taxes the same as property taxes?

This is one of the most important real-world questions: are mortgage real estate taxes the same as property taxes? On a mortgage statement, the “property taxes” line often refers to the annual real estate tax bill that the lender is collecting via escrow.

When taxes are held in an escrow account, the borrower’s monthly mortgage (or mortgage payments) include a portion of the expected annual tax. The lender then pays the county when the bill comes due. That’s why many homeowners say “my mortgage includes property tax”—because escrow is collecting it.

Are real estate taxes the same as property taxes on a 1098 form?

Form 1098 usually reports mortgage interest, and in some cases, it may show amounts the lender paid from escrow for property taxes. However, the key is whether the payment qualifies as deductible real property taxes and whether the homeowner can substantiate it with records and the actual county bill.

For federal deductions, the IRS explains deductible real property taxes must be based on the value of the real property and levied for general public welfare. It also notes that local benefit assessments for improvements (sidewalks, water mains, sewer lines) are not deductible as real property taxes.

Can property taxes be deducted on federal income taxes?

Many homeowners ask about tax deductions and whether property taxes are deductible if they itemize. The IRS resources for homeowners and itemized deductions explain the general rules for deducting state and local real estate taxes (real property taxes), including what counts and what doesn’t.

This is why clear categorization matters: “property tax” in casual language might include fees that are not deductible, while deductible real property taxes must meet IRS requirements.

Mobile home: real estate or personal property?

A mobile home is a classic edge case. In many places, a mobile home is treated as personal property unless it is permanently affixed to land (and sometimes titled as real property). The classification affects whether it’s taxed like real estate or assessed under a personal property framework.

The safest way to answer “how is property taxed” for a mobile home is to check the local assessor’s classification and whether the home is considered affixed to land and treated as real property in that municipality.

Can a Property Owner Block an Easement? Legal Rights, Remedies & State Laws Explained

Do businesses pay both real estate and personal property taxes?

In many areas, yes. Businesses may pay real estate tax on owned buildings/land and personal property tax on business equipment, machinery, or office furnishings—depending on local rules. This is why some guides mention “property taxes include” multiple categories.

For business owners, separating these categories supports cleaner reporting and reduces surprises when a “property tax” notice arrives for items that are not land or buildings.

What happens if you don’t pay your real estate taxes?

If a property owner doesn’t pay the annual real estate tax, penalties and interest typically apply, and long-term nonpayment can lead to tax liens or foreclosure actions depending on local law. This is a high-stakes area, so the best step is to check the county treasurer’s process early and ask about relief, exemptions, or payment plans where available.

Trustworthy External Links

Conclusion

Real estate tax usually means the annual tax on real property (land and buildings). Property tax often means the same thing—but in some places it can also include personal property tax on movable assets. The simplest rule: read what the bill applies to, how the assessor classifies the property, and use IRS definitions when deductions are involved.

Bullet-point summary (most important things to remember)

Real estate tax usually = tax on real property (land + buildings).

Property tax often means the same, but can also include personal property tax in some states.

The bill is typically based on assessed value and a local tax rate.

Mortgage “property taxes” usually means escrow for the real estate tax bill.

IRS rules define what counts as deductible real property taxes and what doesn’t.

2025–2026 context matters: effective rates and average bills vary widely by state and county.

FAQ

Are property taxes and real estate taxes the same thing?

Often yes for homeowners, but “property tax” can be broader in places that also tax personal property.

Is there a difference between real estate taxes and property taxes?

Sometimes. Real estate tax focuses on real property; property tax may include personal property depending on local law.

What is the difference between real and personal property taxes?

Real property taxes apply to land/buildings; personal property taxes apply to movable items (vehicles, boats, business equipment).

Are real estate taxes the same as property taxes on a 1098 form?

Mortgage statements may label escrow-paid taxes as “property taxes,” but deductibility depends on IRS rules and proper documentation.

Can property taxes be deducted on federal income taxes?

Certain real property taxes may be deductible if the taxpayer itemizes, subject to IRS rules and limits.

Are mobile homes taxed as real estate or personal property?

It depends on whether the mobile home is permanently affixed to land and how the local assessor classifies it.

Do businesses pay both real estate and personal property taxes?

In many places, yes—real estate for buildings/land and personal property for equipment (depending on jurisdiction)

What happens if you don’t pay your real estate taxes?

Late fees and interest can apply; long-term nonpayment can lead to liens or foreclosure actions (rules vary by location).

What state has the highest real estate tax?

Tax Foundation’s 2025 data ranks effective property tax rates by state and county.

How do property taxes work if paid through my mortgage lender?

The lender usually collects taxes in escrow as part of mortgage payments and pays the bill when due.

Join The Discussion