Is Property Tax and Real Estate Tax the Same?

Property taxes and real estate taxes are terms often used interchangeably, but are they truly the same thing? In this article, we’ll dive into the definitions, differences, and practical implications of these two tax types. Whether you’re a homeowner, real estate investor, or just trying to understand your tax bill, this guide will provide valuable insights. We’ll also address frequently asked questions and common misconceptions to give you a comprehensive understanding.

Table of Contents

AI Overview: Understanding Taxes in the Modern Age

In this comprehensive guide, we delve into the key differences between property tax and real estate tax, addressing common misconceptions and providing valuable insights for homeowners, real estate investors, and anyone seeking to understand their tax obligations. Despite being frequently used interchangeably, these two terms can have distinct implications depending on the region and type of property being taxed.

We explore how both taxes are assessed, highlight the varying rates across different states, and clarify the exemptions and deductions available for property owners. Through clear and accessible explanations, readers can gain a deeper understanding of the process, helping them make informed decisions when it comes to managing their property taxes.

What is Property Tax?

Understanding the Basics of Property Tax

Property tax is a levy imposed by local governments based on the value of real property (land and buildings). The amount you pay depends on the assessed value of your property, which is determined by a tax assessor. Typically, property taxes fund local services such as schools, infrastructure, and emergency services.

How Property Tax is Calculated

Property taxes are calculated by multiplying the property’s assessed value by the local property tax rate. For example, if a property is valued at $200,000 and the local tax rate is 1.5%, the annual property tax bill would be $3,000.

What is Real Estate Tax?

Real Estate Tax Explained

Real estate tax is often referred to in the same context as property tax, but it can have a broader scope. While property tax typically refers to taxes on land and structures, real estate tax may include additional taxes that apply to the value of the property. This could encompass taxes related to the sale or transfer of property, as well as taxes on the property’s income-generating potential if it’s rented or leased.

Differences Between Real Estate and Property Tax

While both taxes are often linked, the key difference lies in the scope. Real estate taxes generally focus on the land and any structures on it, while property tax can sometimes apply to both tangible personal property (like vehicles or equipment) and real estate.

Property Tax vs Real Estate Tax: Are Real Estate Taxes the Same as Property Taxes?

Is Property Tax and Real Estate Tax the Same Thing?

Unpacking the Common Confusion

The terms “property tax” and “real estate tax” are often used interchangeably, but they have different technical meanings. In many cases, particularly in the United States, real estate tax is simply a subset of property tax. However, depending on your location, you may encounter different terminology, which can lead to confusion.

Why the Confusion?

One of the reasons people mix up these terms is that both taxes are used to fund local services like schools and public infrastructure. Additionally, both taxes are based on the value of your property. Despite these similarities, it’s important to differentiate between the two, especially when it comes to tax planning or understanding your bill.

Real Estate Taxes vs. Property Taxes: Key Differences

Real Estate Taxes and Personal Property Taxes

Real estate tax generally refers to the taxes you pay on immovable property, like land and buildings. On the other hand, personal property taxes can apply to movable assets such as vehicles, boats, and business equipment. Many homeowners confuse the two because they both contribute to a person’s overall tax burden.

Local Variations and Specifics

The terminology used for real estate and property taxes can vary by state or country. For example, in some regions, property tax refers only to real estate, while in others, it includes personal property taxes as well. It’s crucial to understand your local tax laws to avoid confusion.

Are Real Estate Taxes the Same as Personal Property Taxes?

The Difference Explained

While real estate taxes apply to immovable property like homes or buildings, personal property taxes apply to tangible, movable items. In some areas, personal property taxes may be assessed on vehicles, boats, and other assets. These taxes are typically collected by the local government, and the rates can vary depending on your region.

Do Both Taxes Affect Homeowners?

Yes, both real estate and personal property taxes can affect homeowners. Real estate taxes are more common, but if you own valuable personal property, such as a car or boat, you may also be subject to personal property taxes.

How Are Real Estate Taxes Calculated?

Understanding the Assessment Process

Real estate taxes are generally assessed based on the value of the property. The local tax assessor evaluates your property’s market value and then applies the local tax rate. The assessment process can differ by region, but it typically involves regular re-assessments to account for changes in the property’s value.

Example of Real Estate Tax Calculation

For example, if your property is worth $300,000 and the local real estate tax rate is 1.2%, your real estate tax bill would be $3,600 annually.

Tax Deductions and Exemptions: Can You Save on Property Taxes?

Common Tax Deductions

In many regions, property owners can deduct their real estate taxes on their federal tax return. This can help reduce your overall taxable income. Additionally, some areas offer exemptions for seniors, veterans, or low-income residents that can reduce the amount of real estate tax owed.

Exemptions and Benefits

Each state and municipality has different rules about exemptions and deductions. It’s essential to check with your local tax office to understand what you may be eligible for.

Navigating Your Property and Real Estate Tax Bill

Tips for Managing Property Taxes

Understanding your property tax bill can be complicated, but there are ways to manage it. Regularly reviewing your property’s assessed value and appealing if you believe it’s overvalued can help lower your tax bill. Additionally, paying attention to deadlines for payment can help avoid penalties.

Tax Planning Strategies

Consider tax planning strategies such as deferring property taxes or looking into available tax credits that may apply to your situation.

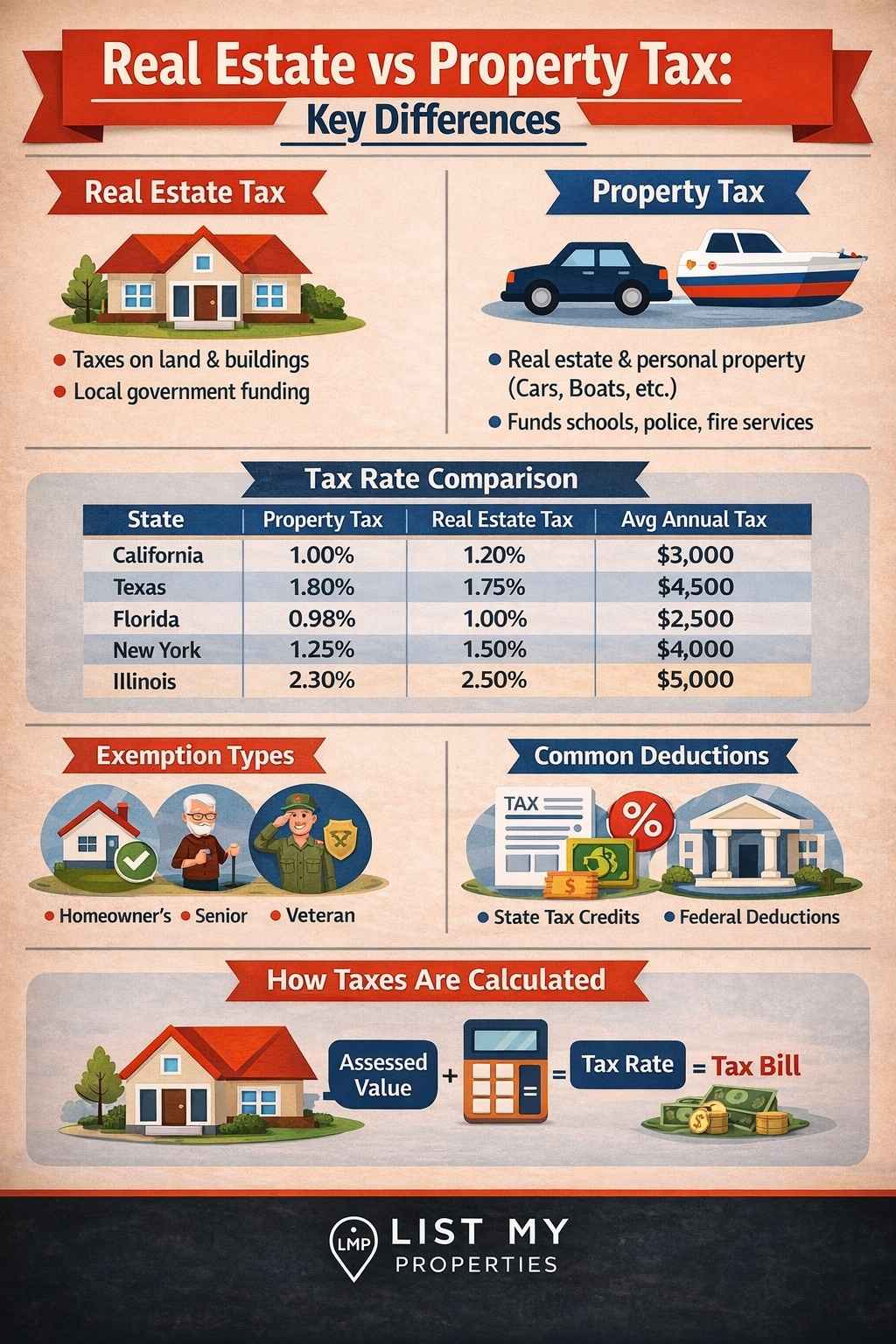

Table Data for Real Estate and Property Tax Comparison

| State/Region | Property Tax Rate (%) | Real Estate Tax Rate (%) | Exemption Types | Average Annual Tax | Tax Deduction Available |

|---|---|---|---|---|---|

| California | 1.00% | 1.20% | Homeowner’s Exemption | $3,000 | Yes (State Tax Return) |

| Texas | 1.80% | 1.75% | Homestead Exemption, Over 65 Exemption | $4,500 | Yes (State Tax Return) |

| Florida | 0.98% | 1.00% | Homestead Exemption, Senior Exemption | $2,500 | Yes (State Tax Return) |

| New York | 1.25% | 1.50% | Basic STAR Exemption | $4,000 | Yes (State Tax Return) |

| Illinois | 2.30% | 2.50% | General Homestead Exemption | $5,000 | Yes (State Tax Return) |

This table provides a quick comparison of real estate tax rates across different states, exemptions available, and average annual tax bills.

Trustworthy External Links

How Long Does It Take to Get a Real Estate License? 2026 Career Guide

Can a Property Owner Block an Easement? Legal Rights, Remedies & State Laws Explained

Conclusion

In conclusion, understanding the difference between property tax and real estate tax is essential for homeowners, investors, and anyone dealing with property in a specific region. Whether you’re looking to manage your taxes better or simply understand your bills, this article serves as a comprehensive guide. Make sure to consult your local tax office for specific details regarding your property tax obligations and any exemptions you may be eligible for.

Bullet-Point Summary: Key Takeaways

Property tax refers to taxes levied on real property like land and buildings.

Real estate tax can encompass both property tax and taxes on income-generating properties or property transfers.

The key difference lies in the type of property being taxed: real estate taxes apply to immovable property, while personal property taxes apply to movable assets.

Tax rates and exemptions vary by region, so it’s important to understand your local tax laws.

Tax deductions for real estate taxes are available in many areas, offering opportunities for savings.

Feature Snippet

Here is a short, SEO-friendly summary designed for a Feature Snippet:

Is Property Tax and Real Estate Tax the Same?

Although “property tax” and “real estate tax” are often used interchangeably, they are not exactly the same. Real estate tax refers to taxes specifically on land and buildings, while property tax can apply to both real estate and personal property, such as vehicles or equipment. It’s important to understand the local tax laws, as the terminology and rates may vary by region.

FAQ Section

Are property taxes and real estate taxes the same thing?

No, although they are often used interchangeably, real estate tax typically refers only to taxes on immovable property, while property tax may also include taxes on movable property.

What is the difference between real and personal property taxes?

Real property taxes apply to land and buildings, while personal property taxes apply to movable assets like vehicles and boats.

Can property taxes be deducted on federal income taxes?

Yes, in many regions, real estate taxes can be deducted on your federal tax return.

Join The Discussion